3 Strategies to Maximize the Private Equity Investment Process

Despite uncertainty from the COVID-19 pandemic and the volatility in the financial markets over the last few years, private equity (PE) fundraising continues to break records. In 2021, the number of closed PE funds surpassed 4,000 for the first time – with the average fund size exceeding an unprecedented $1 billion mark. Due to these massive liquidity injections into the financial system, private equity competitiveness is at an all-time high. Implementing private equity deal sourcing best practices is critical to finding an edge over the competition.

A recent McKinsey’s Private Markets Annual Review found that over 7,000 firms threw their hats in the PE ring worldwide.

In this blog, we highlight three essential private equity deal sourcing best practices you can start implementing today. If you want to ensure that you have a solid private equity deal flow moving forward, invest in these three essential parts of the private equity investment process:

1. Put Relationships First

2. Leverage AI Deal Sourcing

3. Segment Deals Based on Defined Criteria

Let’s break down each of these three essential PE best practices and see how each one can help your firm source better deals.

1. Put Relationships First

The private equity industry is built on relationships. Firms must cultivate strong connections to secure consistent funding from limited partners. Ranging from institutional funds to high net-worth individuals, limited partners are some of the most well-connected resources a private equity firm can tap into. When you maintain value-driven relationships with existing investors who support your track record, introductions to prospective opportunities are common, further enhancing your private equity deal flow.

In addition to relationships with investors, private equity firms must stay engaged with companies they are prospecting. Whether through sharing industry-specific research reports or making potential introductions related to business development, firms must stay active to prove their worth as potential future partners.

Lastly, don’t underestimate the relationships investment bankers have built in the private markets. They can also provide insights on recently closed transactions they’ve been personally involved in and introduce new opportunities.

Private equity firms must maintain strong relationships with all their stakeholders to succeed. By regularly communicating with the movers and shakers in the markets, private equity firms can position themselves ahead of their competition.

2. Leverage AI Deal Sourcing

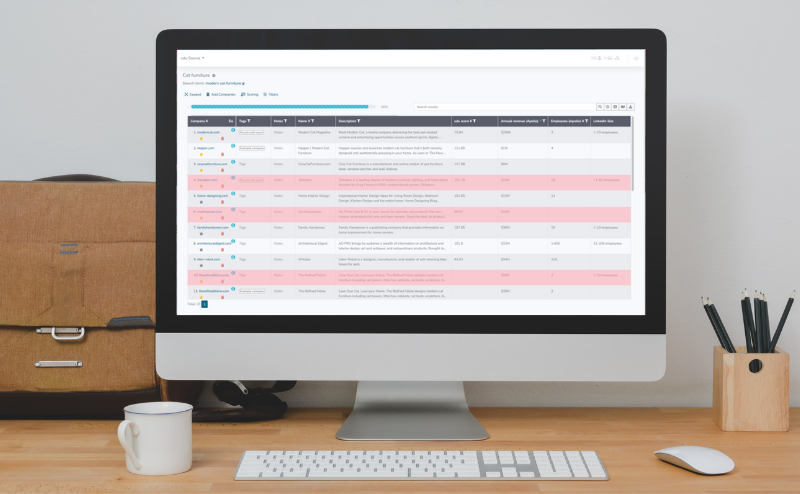

One of the most impactful private equity deal sourcing best practices is to leverage AI deal sourcing. Built on machine learning algorithms, an AI-powered deal sourcing platform can help private equity firms source and screen deals more efficiently. Not only can AI help identify key decision-makers, but it can also predict which companies are most likely to succeed. This allows PE firms to be more nimble and first to the table when new opportunities arise.

There are several unique benefits that an AI deal sourcing platform can bring to the private equity investment process:

Greater Access to Sourcing Deals

By leveraging an AI-powered deal sourcing platform, private equity firms can have greater access to a larger pool of potential deals. Rather than relying on a small team of professionals to manually source deals, AI can help identify a broader range of opportunities – much faster than humanly possible.

Improved Efficiency

One of the main advantages of using AI for private equity deal sourcing is that it can help improve the efficiency of the process. On average, AI-powered deal sourcing can access and analyze 195 potential deals per minute – compared to 1 by traditional methods. Plus, these tools run at full capacity, 24 hours per day, seven days per week, whether your team is in the office or not.

Increased Accuracy

By analyzing large amounts of data, machine learning can identify patterns and correlations humans simply can’t see. AI systems can read through thousands of data sources based on PE firms’ criteria – making it easier to identify the best deals.

Utilizing AI for private equity deal flow offers untold benefits and efficiencies. Firms that leverage this relatively new technology will have a competitive advantage over those that use more traditional, outdated methods.

3. Segment Deals Based on Defined Criteria

Not all deals are created equal. One of the best practices for private equity firms regarding private equity deal flow is to segment deals based on defined criteria. By doing this, firms can more easily identify, prioritize, and evaluate opportunities that meet their ideal criteria. This is especially helpful when using AI tools, as algorithmic scoring can help firms zero in on results that match their criteria more efficiently.

Segmenting deals based on defined standards and metrics like investment stage, company size or sector, and geographic location is one of the most critical private equity deal sourcing best practices.

Firms should also consider what type of deal they’re looking for, such as bolt-on acquisitions or platform investments. By defining the criteria upfront, firms can avoid wasting time on deals that aren’t a good fit – and focus their efforts on those more likely to succeed.

Growth in private equity continues to trend upward, with confidence in the private markets at an all-time high. This has led to increased private equity deal flow and fundraising as private equity firms look to capitalize on the current market conditions.

Supercharge the Private Equity Investment Process With udu

There are several private equity deal sourcing best practices that firms can use to maximize their deal flow and the overall private equity investment process. These include leveraging AI deal sourcing, segmenting deals based on defined criteria, and putting relationships first.

If you want to take advantage of current market conditions and source opportunistically, contact udu today. As the leading AI private equity deal sourcing platform, we can help you:

- Find and assess opportunities more efficiently

- Save time by automatically sourcing and evaluating potential deals 24/7

- Get more accurate results with our algorithmic deal scoring

- Connect with the best targets through AI-driven categorization

- And much more!

To learn more about how udu can help you maximize private equity deal flow and improve your investment process, schedule a free demo. Discover how the power of AI can help you take these three private equity deal sourcing best practices and turn them into a competitive advantage.